Many articles mention, that the limited Bitcoin money supply is a major advantage of this digital currency. The reasoning usually goes like this. Since Bitcoins can only be created through mining and there is an upper limit of 21 million, Bitcoin is supposed to be inflation proof. This article for instance says, Bitcoin “theoretically eliminates inflation”. If this was true, Bitcoins would not lose purchasing power. The Bitcoins I own today would buy me the same amount of goods and services tomorrow. Or a larger amount in the case of deflation.

From the quantity theory of money we know, that there is a link between inflation and the money supply. A substantial growth of the money supply through money printing at some point is going to cause a loss of purchasing power. Therefore it is interesting to take a closer look at how money is created in the Bitcoin world and how the Bitcoin money supply grows.

Money creation of a fiat currency

While Bitcoins are mined, producing fiat money is called money creation. In a simplified view, there are two different types of money creation. Money is either created by the central bank or money is created by commercial and other banks.

Money created directly by the central bank is called the monetary base. It comprises currency in circulation (notes and coins) and deposits of monetary financial institutions (MFIs) at the central bank. The monetary base is also called high-powered money because an increase in the monetary base can multiply to a much larger increase in the total money supply. The central bank applies a number of measures when it wants to create additional money. Through open market operations the central bank grants loans to MFIs against collateral. The loan amount is credited to the MFI whereby the MFI increases the deposits it holds at the central bank.

Commercial banks create money through lending. When a person holds a deposit at a bank, the bank can take this money and lend it out to a borrower. The borrowed money in turn will be held as a deposit at a bank (unless it is converted to paper money) which again can lend this money out. Money creation from lending already existed in ancient societies where all money was represented by physical precious coins. Imagine someone takes one coin to buy a vase. The seller of the vase holds this coin as a deposit at his bank. The bank lends this coin out to a second person. This second person also buys a vase for this coin and the seller brings the coin to the bank again. This process could be continued endlessly, as long as the bank finds enough trustworthy borrowers. In this example, one physical coin bought two vases worth two coins in total.

When money is created through lending this is also called fractional reserve banking. That’s because central banks require commercial banks to hold a certain fraction of its client’s deposits as a reserve in a central bank account. The European Central Bank’s reserve ratio is currently 1%. So if a client holds a deposit of EUR 100 at a given bank, only EUR 99 can be lent out to borrowers. We can calculate the maximum amount of money created from fractional reserve banking with the money multiplier. The money multiplier equals 1 divided by the reserve ratio. With a reserve ratio of 1% the theoretical money multiplier is 100, therefore a deposit of EUR 100 can be lent out so often that in total EUR 10,000 have been created. This also highlights why the monetary base is called high-powered money.

The money supply M1

The money supply of fiat currencies is clustered in three groups called M1, M2 and M3. The definitions of what counts as money and to which of the three groups it belongs varies. An overview is sufficient for our purposes.

M1 is also called narrow money. It includes notes and coins in circulation plus deposits of people and non-financial businesses (the public) held in current or checking accounts at MFIs. M2 includes M1 plus savings deposits and time deposits. M3 includes M2 plus money market instruments with a maturity of less than 2 years.

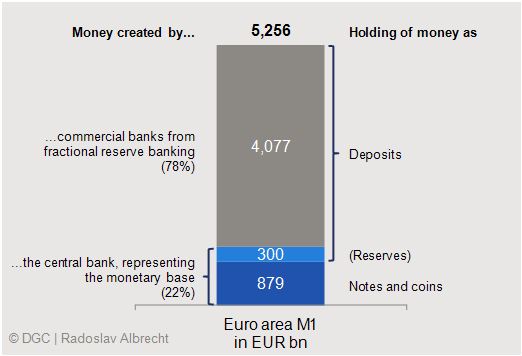

Let’s take a closer look at the components of M1 for the Euro zone. It is important to note that M1 contains both, money created by the central bank as well as money created by commercial banks. 75% of M1 were created from fractional reserve banking by commercial banks. Only 22% of M1 is comprised of the monetary base which was created by the central bank. The monetary base contains EUR 300 bn of MFI reserves held in central bank accounts. These EUR 300 bn are the basis for fractional reserve banking. Therefore the effective money multiplier in the Euro zone is currently somewhere at 14.

Caption: Euro area money supply M1 as of June 2013; data source: ECB statistical data warehouse

Creation of the Bitcoin monetary base

Now that we have introduced money supply and money creation for a fiat currency, we can look at these terms from a Bitcoin point of view.

Bitcoins are created through mining. Mining is comparable to the original endowment of the public with money that was created by the central bank. Therefore mined Bitcoins are part of the Bitcoin monetary base. However, there are significant differences between mining and money creation by the central bank. When the public is endowed with new money after a currency reform, money creation by the central bank does not stop. The central bank keeps increasing the monetary base further which can cause inflation. In the Bitcoin currency system nobody can increase the Bitcoin monetary base beyond the Bitcoins that are created from mining. There is no central bank in power. Mining is the only source for the Bitcoin monetary base. Thus, mined Bitcoins are the Bitcoin monetary base – and not just a part of it.

Also, we never know how much money will be created by a central bank in the future. The central bank doesn’t know it itself because monetary policy depends on economic variables that can change quickly. In contrast, Bitcoin mining is predictable. We know with high certainty how many Bitcoins will be mined over a specified time and therefore the growth rate of the Bitcoin monetary base is predictable. As we can see on the following chart the growth rate will decline dramatically in the near future.

Caption: Bitcoin monetary base and growth (actual 01-2009 until 08-2013 and projection until 2029); data source: blockchain.info, own calculations

Bitcoin money creation from lending

As we have seen with the fiat currency, the second way of money creation is lending by commercial banks. If lending activities existed in the Bitcoin currency as well, the total Bitcoin money supply would exceed the number of mined Bitcoins (the Bitcoin monetary base). Such Bitcoin lending operations already do exist. Such sites are listed under the lending section of the Bitcoin Wiki Trade page.

Some of these sites are based on a peer-to-peer lending model and some operate like a Bitcoin bank. In the latter case the site collects deposits and grants loans to Bitcoin borrowers directly. Both models have certain advantages and drawbacks. I won’t go into this here. The important point to note is that Bitcoin lending does take place.

This means Bitcoins are not only created from mining but also from lending. However, the number of Bitcoin lending sites is not large. Even though they do not publish any figures, it can be assumed that relative to mined Bitcoins, the number of Bitcoins created through lending is small. Since Bitcoin lending currently is not explicitly regulated, there is no fractional reserve requirement. One could argue, this means that the money multiplier is theoretically infinite. A Bitcoin bank could lend the deposits it holds ad infinitum. It will be interesting to see how this evolves. Anyhow there something like a natural cap just from the fact that those who are willing to lend will not find infinitely many borrowers with sufficient creditworthiness.

Bitcoin money supply

If we want to know the Bitcoin money supply we first need to look at the number of Bitcoins in circulation from mining. This figure is currently at about 11.7 million Bitcoins. It represents the Bitcoin monetary base. The calculation of the Bitcoin market capitalization is also based on this figure. They are the same thing, in one instance expressed in Bitcoins and in another instance expressed as the US dollar value. That means the Bitcoin market cap equals the monetary base, currently it is USD 1.3 bn. If we want to compare the Bitcoin money supply to the money supply of other currencies we have to compare this USD 1.3 bn to the monetary base of the respective currency. Sri Lanka for example has a monetary base of approximately USD 2.5 bn which means that the Bitcoin monetary base is slightly more than a half of Sri Lanka’s monetary base.

What should not be done is to compare the Bitcoin monetary base to the M1 money supply of fiat currencies. As long as there are no figures on the total outstanding Bitcoin loan volume available, we won’t know what Bitcoin M1 is. We would need to sum up mined Bitcoins and outstanding Bitcoin loan volume in order to get Bitcoin M1. As we have seen on the Euro zone example, the larger part of M1 is created from lending. A comparison of the Bitcoin monetary base with M1 of other currencies would try to compare two incomparable figures.

Bitcoin has the potential to preserve long-term purchasing power

When we sum this post up, two things become clear. One, Bitcoins are not only created from mining but also from lending. Two, in order to measure the total Bitcoin money supply we need to add lending volume to the number of mined Bitcoins. What is the conclusion from this regarding the growth of Bitcoin money supply?

The Bitcoin monetary base grows at a predictable rate and the growth rate goes to much lower levels from 2014. That’s when the 2013 reduction to 25 Bitcoins per block jumps in. This means the Bitcoin monetary base is not of concern. Bitcoin lending deserves more attention as it is only at the beginning and could evolve to become more significant.

As a first estimate about the impact of Bitcoin lending two things can be noted. Currently a high Bitcoin volatility poses an exchange rate risk on both, borrowers and lenders. We can expect lending to increase with declining volatility. The second thing is that Bitcoin will remain in deflation as long as the user base keeps growing faster than the Bitcoin money supply. A deflationary currency increases incentives to build savings instead of borrowing money. Therefore we can expect the Bitcoin lending volume relative to the monetary base to be low. Probably much lower than we have seen it in the Euro zone example.

Since the Bitcoin monetary base growth will decline and Bitcoin lending is less significant than for a fiat currency, Bitcoin can be expected to remain deflationary for the years to come. This is a good message. It means that Bitcoin is not just an instant and cost effective payment network but also a stable currency that preserves purchasing power. Inflation is not fully eliminated because the money supply can grow significantly from lending. But as we have seen this is quite unlikely.

Written by Radoslav Albrecht

___________________________________________

Radoslav Albrecht studied economics and finance in Germany and Great Britain. He worked in investment banking and strategy consulting before he became a Bitcoin entrepreneur. At the beginning of 2013 Radoslav cofounded the peer-to-peer Bitcoin lending site Bitbond.net. He also runs the German website bitcoins21 which explains brick and mortar shops how they can integrate and accept Bitcoin as a means of payment.